2024 Home Office Deduction Schedule Class I To

2024 Home Office Deduction Schedule Class I To – (Data show that the number of people working from home nearly tripled over the past few years). That may make you wonder whether you can claim a home office deduction is claimed on Line 30 of . You must have some Schedule C income from self-employment to be eligible for the home office deduction. Does Your Home Office Qualify for the Tax Break? Your home office must meet certain .

2024 Home Office Deduction Schedule Class I To

Source : thecollegeinvestor.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comBGFS INC | Riverdale IL

Source : m.facebook.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comAime & Co. Tax Services | Linden NJ

Source : m.facebook.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.com2024 Federal Tax Calendar | Bloomberg Tax

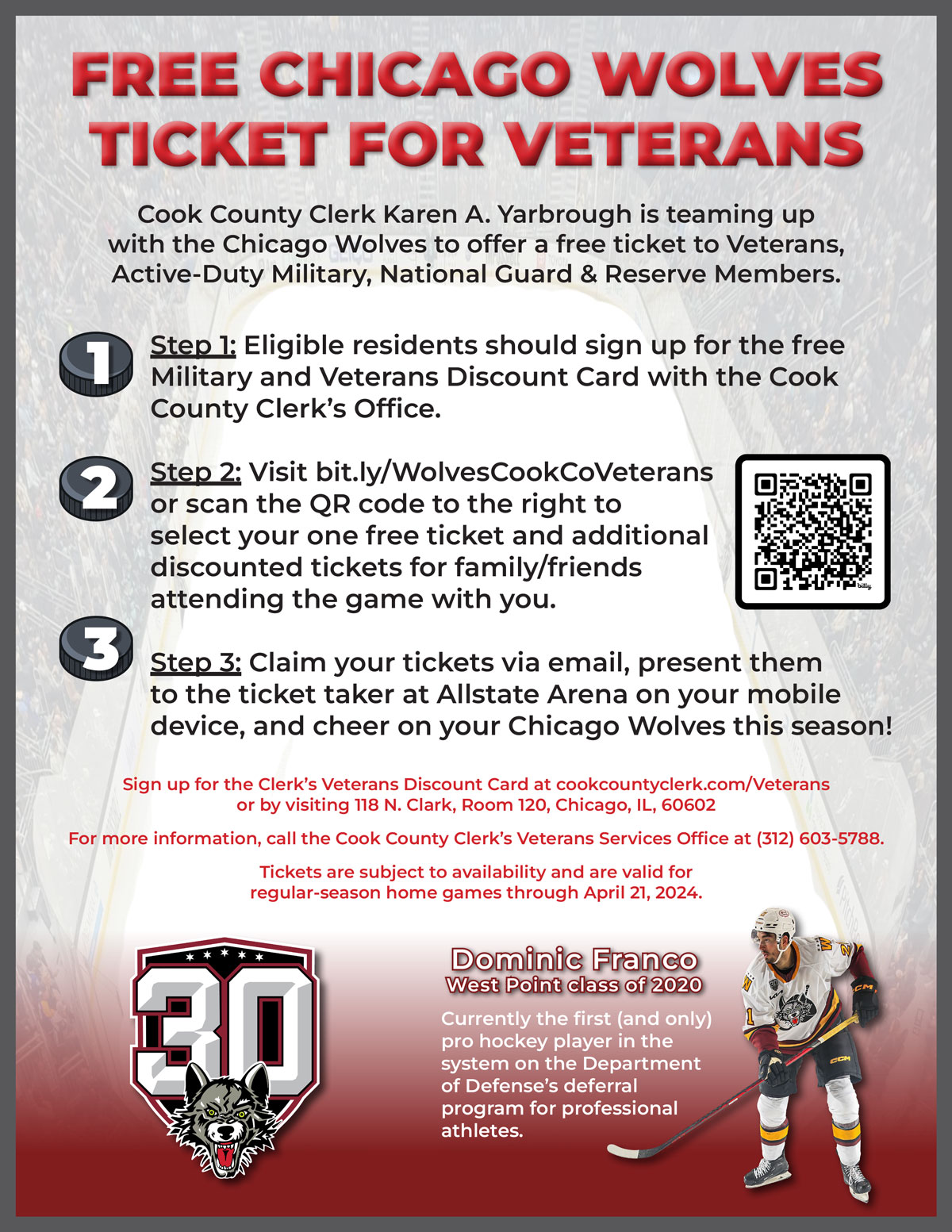

Source : pro.bloombergtax.comCook County Clerk Teams Up with Chicago Wolves Hockey to Offer

Source : www.coalitionofvets.orgYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.com2024 Home Office Deduction Schedule Class I To When To Expect My Tax Refund? IRS Refund Calendar 2024: However, it’s not claiming the home office deduction that may catch the attention of the IRS, but filing a Schedule C in general. “So many people over the years have abused the deductions of . The home office deduction There’s a line on Schedule C dedicated to reporting your advertising expenses. What else you can do: Check out the qualified business income deduction. .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)